Which is the best spot Bitcoin ETF

The US SEC approved 11 spot Bitcoin ETFs on 11 January 2024. In this article, we explore which spot Bitcoin ETF you should consider.

The US SEC approved 11 spot Bitcoin ETFs on 11 January 2024. In this article, we explore which spot Bitcoin ETF you should consider.

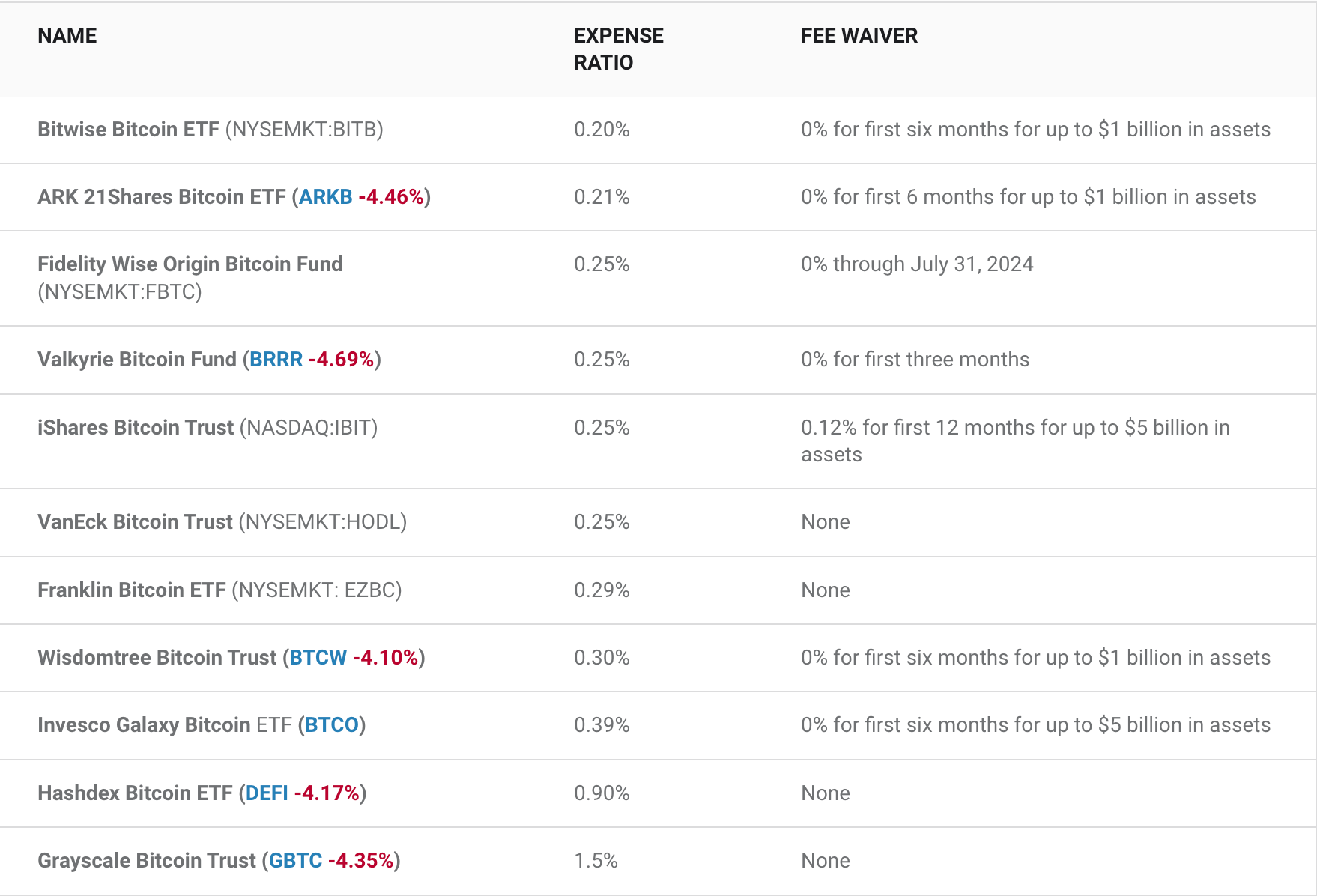

By expense ratio

Bitwise is the winner, with the lowest expense ratio at 0.20%. This is an important criterion. As your Bitcoin value compounds, so does the management fee.

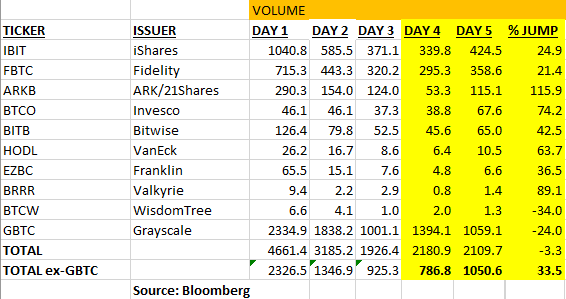

By volume

Below are the volumes of the 1st five days.

Ignore GBTC (Grayscale) volume, as they are outflows. To understand more, check out my article on why Bitcoin prices are flat after spot ETF approvals.

IBIT by BlackRock and FBTC by Fidelity are the clear winners here. ARKB, BTCO and BITB have done decent volumes.

By experience

Experience is based on two factors—experience in ETFs and experience in Bitcoin.

In ETFs, BlackRock is the clear winner. They manage more than 700 ETFs globally.

For Bitcoin - Arc, Fidelity and Bitwise have been involved with Bitcoin for a long time and understand it deeply. Bitwise has committed to donating 10% of the profits to Brink (supports Bitcoin developers), OpenSats and the Human Rights Foundation.

Though you cannot go wrong with any of the top Bitcoin ETFs, I recommend BITB, ARKB and FBTC in this order.

Comments ()