What Triggered Past Bitcoin Crashes After Peaks?

While the whole market is bullish, I don't want to play party pooper. However, it will be helpful to look at what events in the past triggered Bitcoin crashes after peaks.

Welcome to the BTC Lighthouse report.

Bitcoin touches a new peak of $71k. A critical look at history.

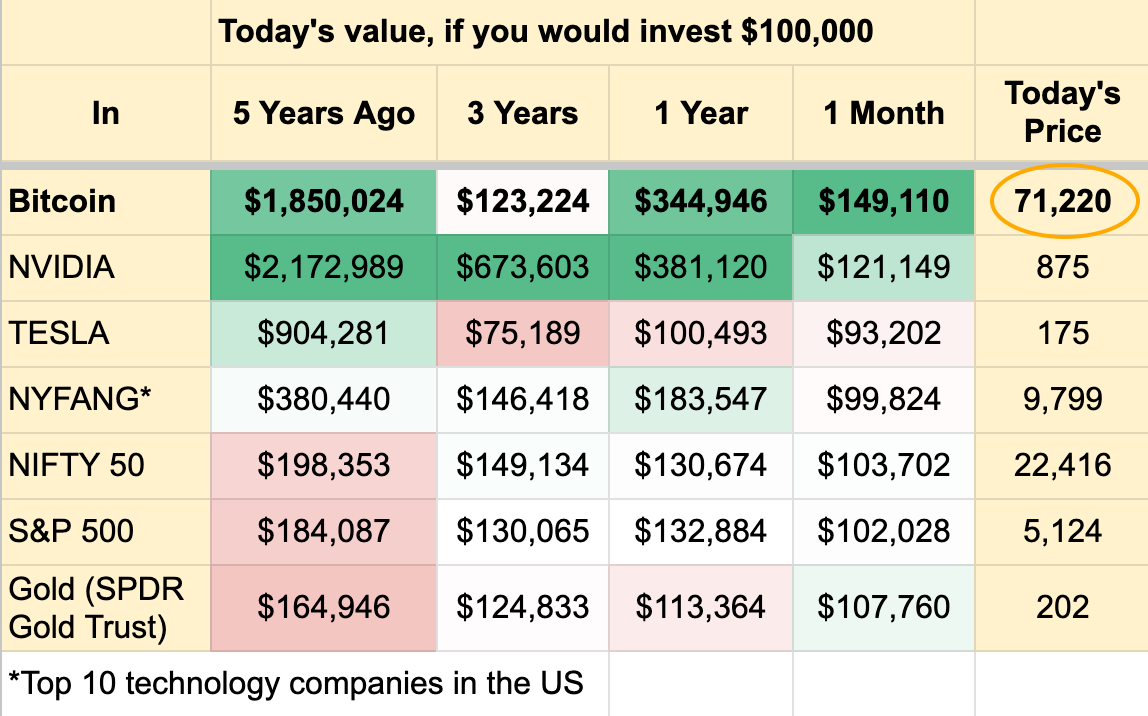

📈 Bitcoin Price

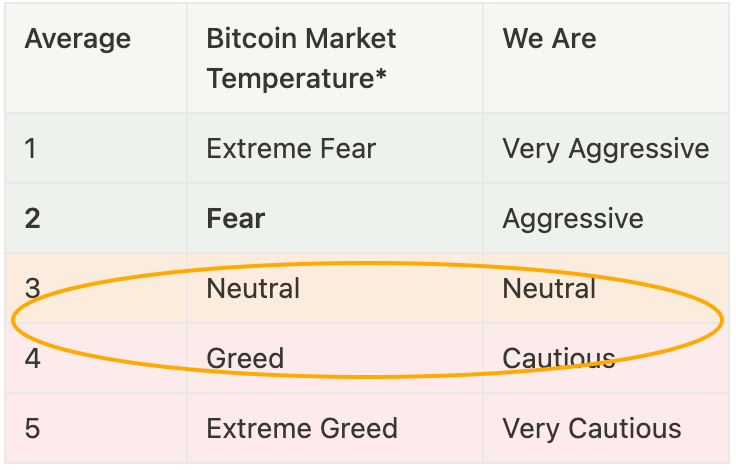

🌡️ Temperature

The BTC Lighouse temperature remains unchanged at 3.6, just slightly in the Greed zone.

While the whole market is bullish, I don't want to play party pooper. However, it will be helpful to look at what events in the past triggered Bitcoin crashes after peaks.

2014 Crash After $1,100 - Mt. Gox

In 2014, Mt. Gox, the largest Bitcoin exchange, suffered a security breach. Hackers stole an estimated 850,000 bitcoins. This event shook investors' confidence in the security of exchanges, and Bitcoin crashed after its peak of $1,100.

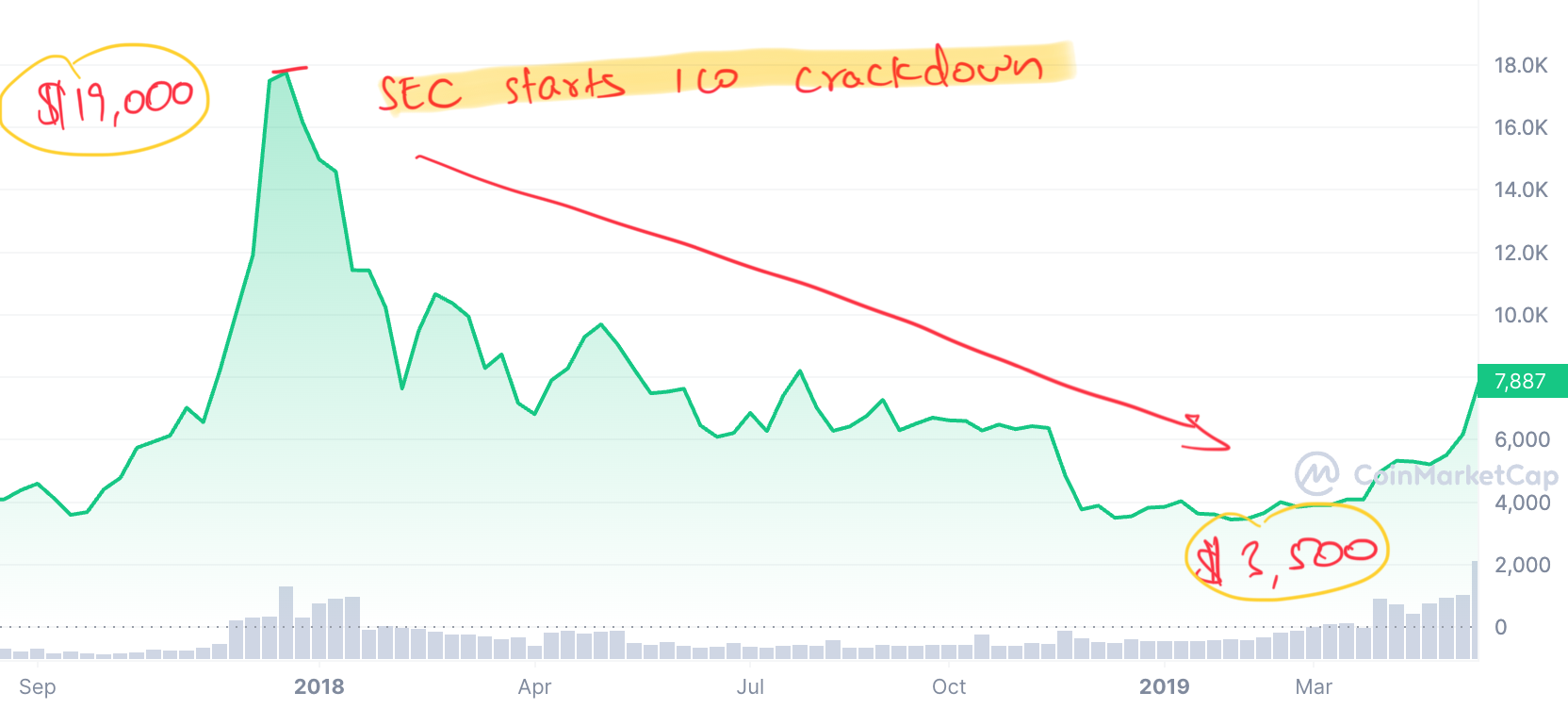

2017 Crash After $19k - ICO Crackdown

The end of 2017 saw the peak of the ICO (Initial Coin Offering) craze, where numerous projects raised funds in cryptocurrencies, often with little more than a whitepaper. This period coincided with increasing scrutiny and regulatory actions from governments and financial authorities worldwide concerned about the speculative bubble and potential fraud. The combination of these factors led to a loss of investor confidence and a significant market correction in Bitcoin and other cryptocurrencies.

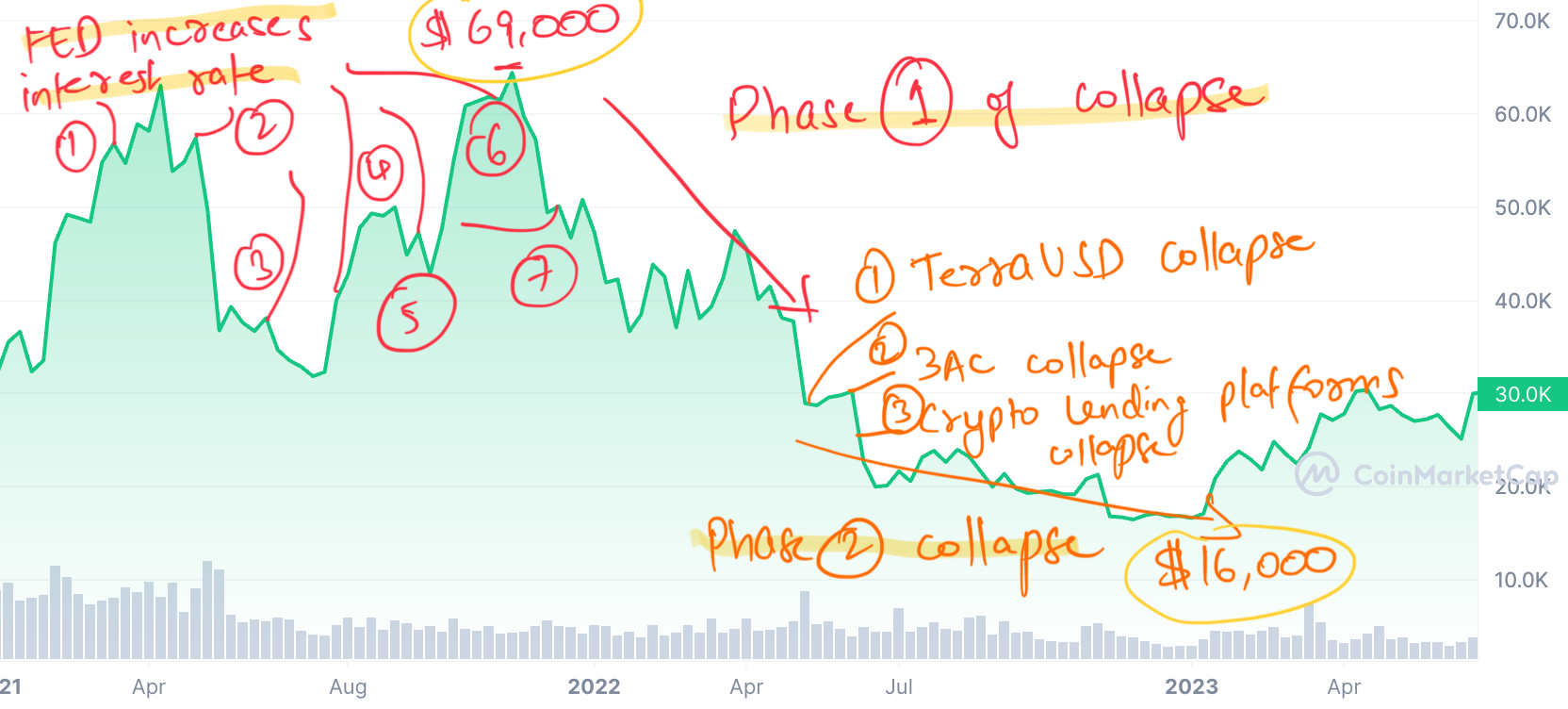

2022 Crash After $69k - FED And Crypto Companies Collapse

In 2022, the broader economic environment was characterized by rampant inflation, which prompted the Federal Reserve and other central banks to hike interest rates. The FED hiked interest rates 7 times. This led to reduced liquidity and a shift away from riskier assets, including Bitcoin.

This had a cascading effect on leveraged crypto companies. The collapse of the algorithmic stablecoin TerraUSD (UST) and hedge fund Three Arrows Capital (3AC) triggered a market-wide sell-off. The revelation that nearly every large centralized crypto lender had failed to manage risk properly led to a contagion-style event. The collapse of these entities had a domino effect, impacting other firms and shaking investor confidence in Bitcoin.

I am very bullish about Bitcoin. However, narratives change in a very short time, and while everyone is bullish, I wanted you to take a pause and look at history.

❗On The Radar

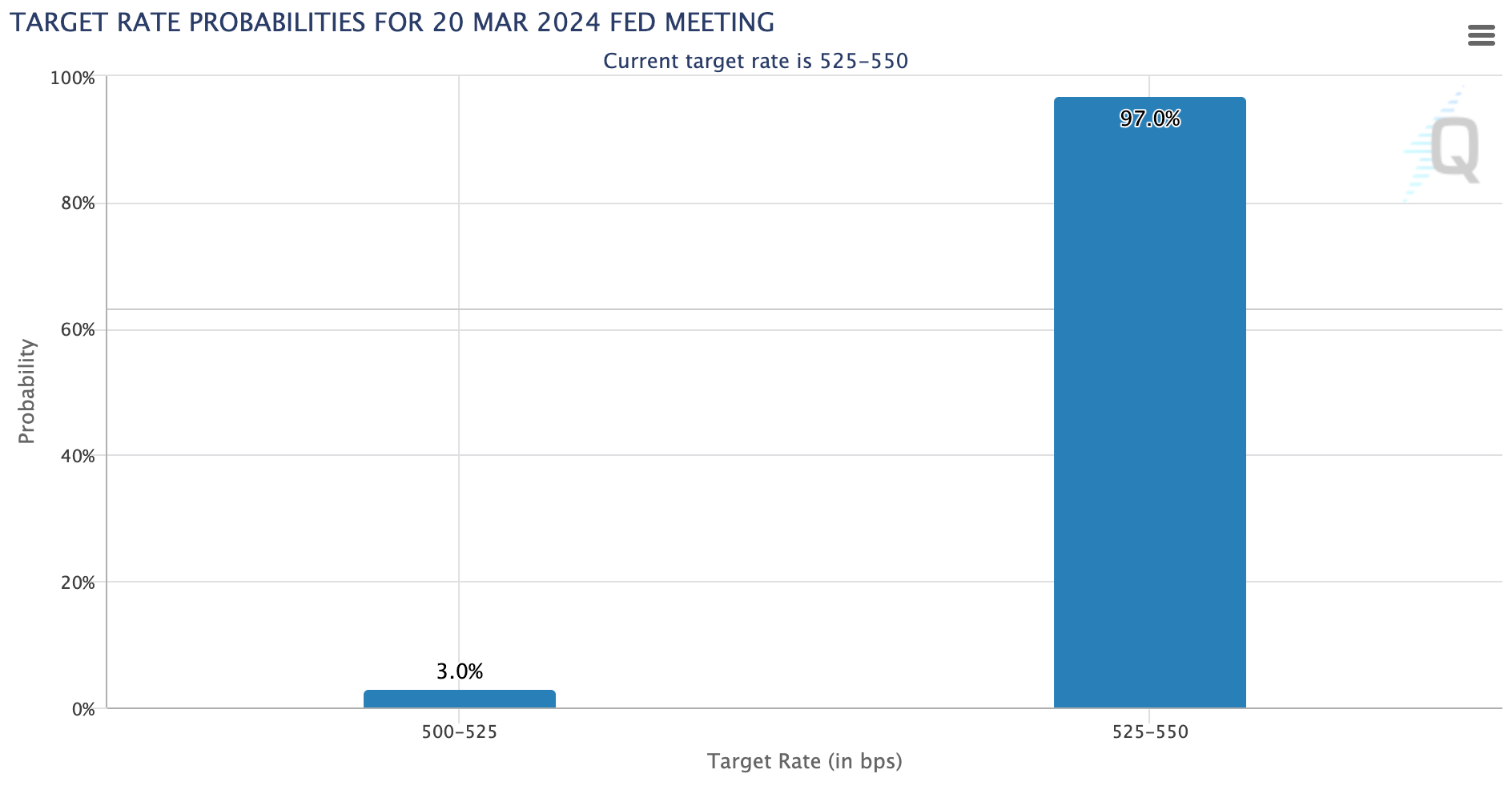

🏦 FED Interest Rates

The one thing that could pop this cycle would be a reversal of policy by the FED if inflation starts creeping up. I do not expect this to happen. In a recent video, Cathie Woods explained why the US could be heading into a recession.

97% of the market is not expecting a rate increase by the FED in the next meeting.

My advice remains the same as my previous 2 reports. You don't need to do anything if you have liquidity for the next 1-2 years. If you don't, or worse, are leveraged, now is the time to pay off your debts, get out of leverage, and start selling by dollar-cost-averaging till you have enough liquidity. If you are a new Bitcoiner, you are not getting Bitcoin cheap. Be prepared for short-term dips and have the conviction for the long term.

🃏Meme Corner

Are you mentally prepared? #Bitcoin pic.twitter.com/7x2Ea4z74w

— Vivek⚡️ (@Vivek4real_) March 11, 2024

Please give your comments and feedback. See you in the next block.

Sandeep Goenka

Comments ()