🌡️ What Is The Bitcoin Temperature?

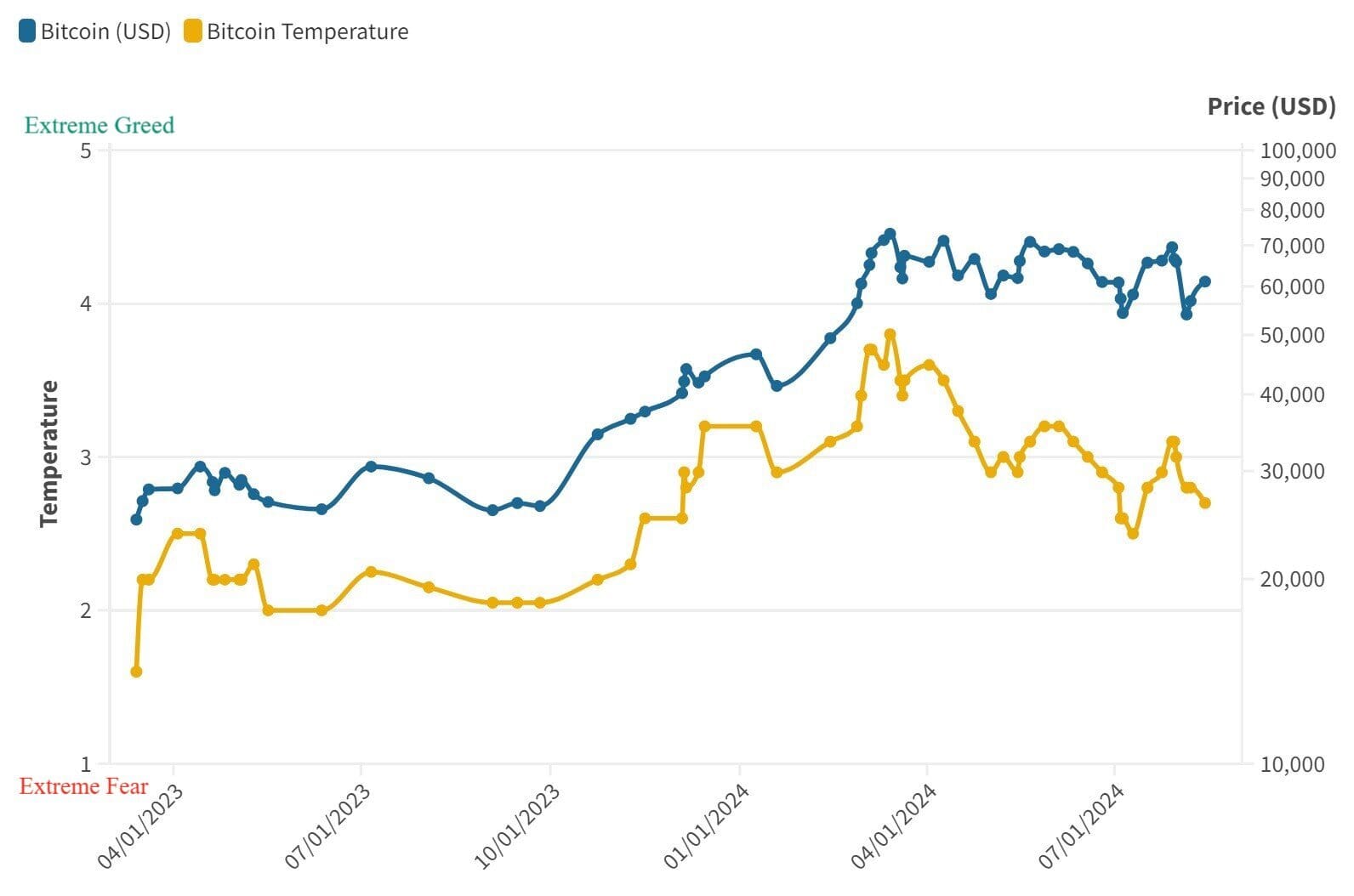

As a Bitcoin investor, it's common to want to keep tabs on Bitcoin's price and performance in the market. However, with the volatile nature of Bitcoin, it can be challenging to determine where it is in its current price cycle. This is where the Bitcoin Temperature comes into play.

To see the current Bitcoin Temperature, visit the Bitcoin Temperature page.

The Bitcoin Temperature helps investors understand where Bitcoin is in the current price cycle. I designed it after reading one of the best books on investment, "The Most Important Thing" by Howard Marks. It's important to note that the Bitcoin Temperature is not intended for trading purposes. Instead, it provides a high-level perspective of Bitcoin's current position in the market.

The Bitcoin Temperature can be used like a dial to decide how passive or aggressive you should be about your Bitcoin investment. Being passive or aggressive can mean different things to different investors, depending on your situation. When the market is greedy, it's prudent to be passive, and vice versa.

Passive strategies when the market is greedy

- Get out of debt by selling Bitcoin and paying it off.

- Slow down your Bitcoin buying.

- Pause your Bitcoin buying.

- Sell some Bitcoin if you need the money.

- Sell some Bitcoin to book profits.

- Sell some Bitcoin and diversify your portfolio by buying other assets.

Aggressive strategies when the market is in fear

- Buy Bitcoin.

- If you buy using dollar-cost-average, increase the dollar amounts of your Bitcoin purchase.

- To buy Bitcoin, you can keep fewer liquid assets, like cash and bank balances, which you will not need for more than 2-5 years.

- Sell some of your other investments and increase your Bitcoin holdings.

How do I calculate the Bitcoin Temperature?

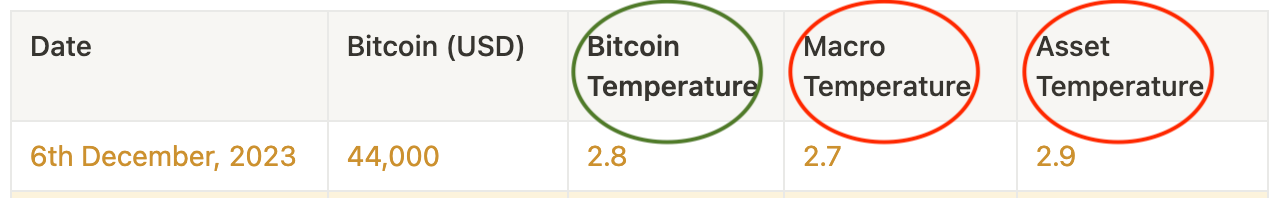

I give a rating between 1 and 5 to 1) the macro environment and 2) Bitcoin, the asset. See the red circles below. The average of these 2 is the Bitcoin Temperature in the green circle below.

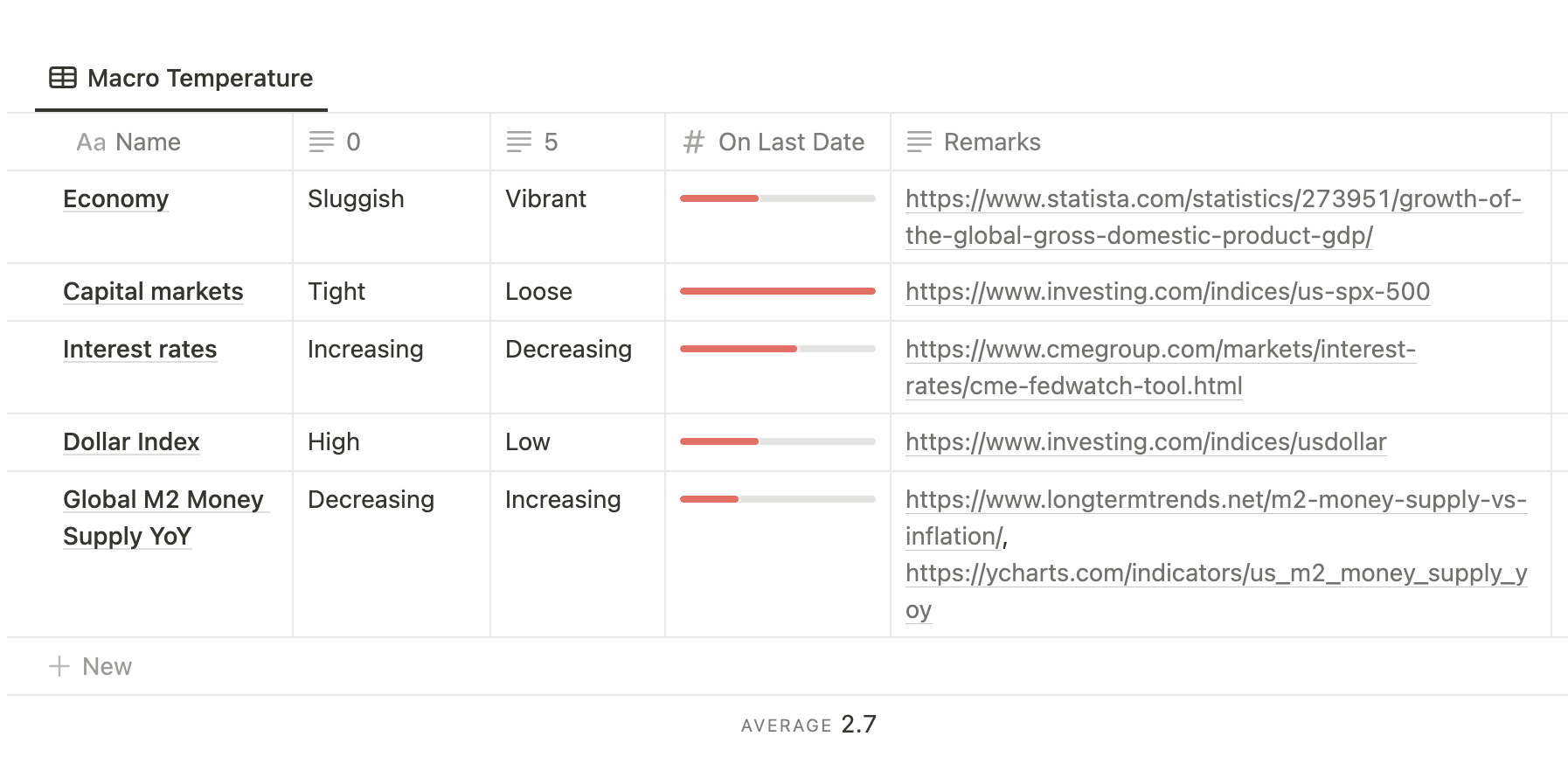

Bitcoin is a macro asset like gold. In fact, with the intervention of central banks, all assets have started behaving like macro assets. But that's a whole different topic which I encourage you to understand. Bitcoin is affected by macro conditions like interest rates, money supply, overall investment sentiment, etc. This is the Macro Temperature.

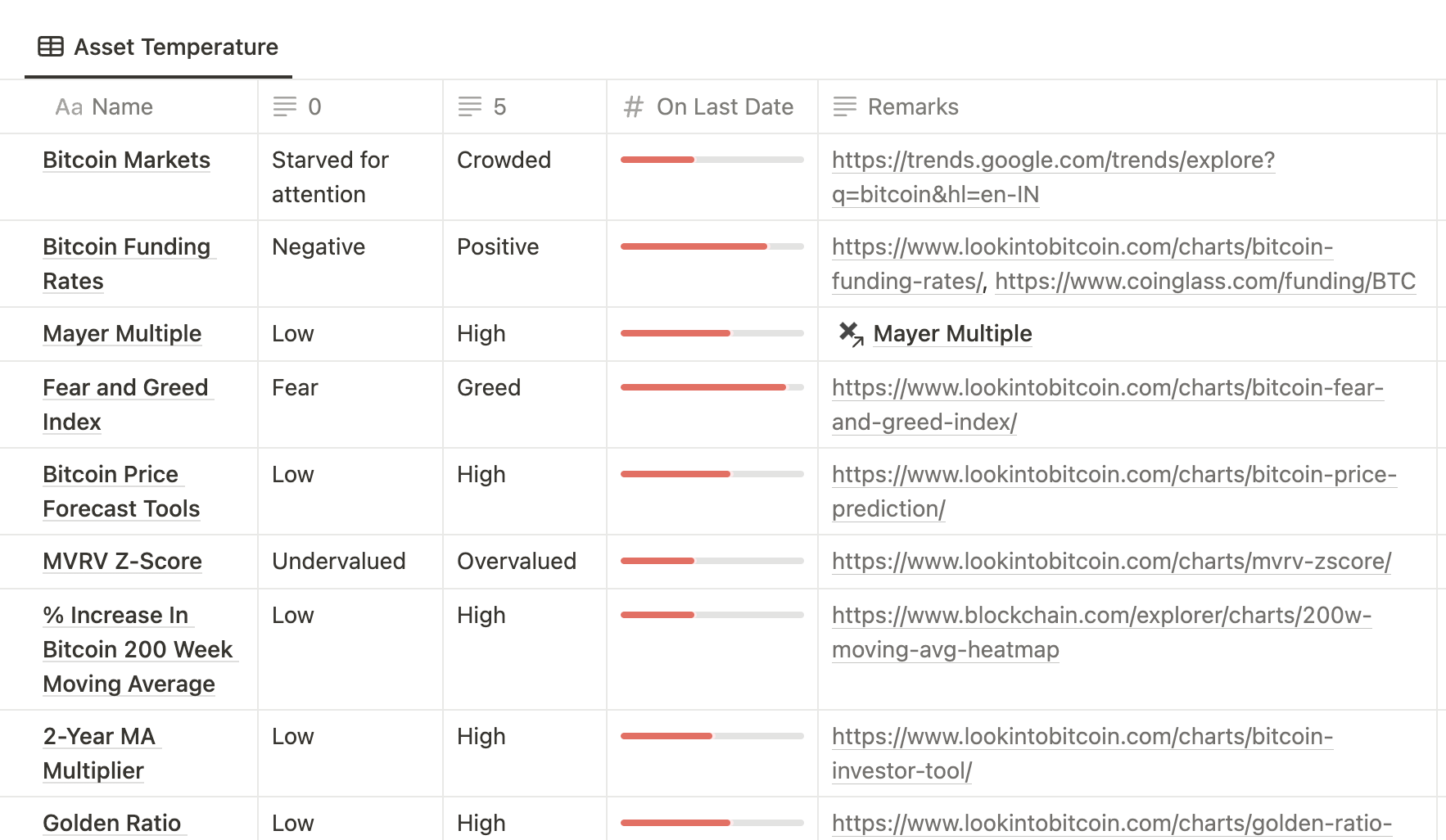

Bitcoin also moves in its cycle. Over the last few years, many new models have been created to understand where Bitcoin is within a cycle. Since Bitcoin is a public blockchain, a lot of data can be analyzed, which shows the behavior of investors. The models show the speed at which Bitcoin's price moves, whether long-term or speculative investors are more active, etc. From these models, we get the Asset Temperature for Bitcoin.

Since Bitcoin is equally affected by the macro conditions and its environment, I take the average of these two to get the Bitcoin Temperature.

The Bitcoin Temperature is not back tested as it is not supposed to be used for trading. It also does not predict the future Bitcoin price.

I suggest the following two steps in your Bitcoin investment journey.

Step 1

Build your conviction, backed by knowledge, that Bitcoin is an investment opportunity in the long term. From my research, I believe that Bitcoin is a lifetime opportunity. The Bitcoin Temperature cannot help with this step. This website has resources to help you in this journey, especially my BTC Masterclass.

Step 2

Every asset is cyclical. The market experiences greed and fear as it tries to make sense of it. This is especially true for new technologies. The Bitcoin Temperature gauges Bitcoin's cycle.

No one can know what the price of any asset is going to be in the future, especially in the short and medium term. However, you have all the information about the price conditions today. The Bitcoin Temperature is to help you make sense of the Bitcoin price today. It acts as a risk dial, which you can use to be aggressive or passive in the current market.

Disclaimer: It's important to remember that Bitcoin's price can be affected by various factors, including supply and demand, market sentiment, and regulatory changes. Therefore, the Bitcoin Temperature should not be the sole factor in your investment decision-making process. It is essential to do your research and seek guidance from a financial advisor before making investment decisions.

Comments ()