Forecasting Bitcoin Prices: A Monte Carlo Simulation Approach

In the volatile world of cryptocurrency, predicting Bitcoin's future price is a challenge that intrigues investors and enthusiasts alike. Today, we'll explore a powerful tool that can help us understand potential price ranges: the Monte Carlo simulation.

What is a Monte Carlo Simulation?

Before we dive into the results, let's briefly explain what a Monte Carlo simulation is:

- A statistical method is used to model the probability of different outcomes in a process that cannot be easily predicted due to the intervention of random variables.

- It's named after the famous casino in Monaco, reflecting its random nature.

- In finance, it's often used to model investment outcomes and assess risk.

We'll use historical price data for our Bitcoin price forecast and run thousands of random simulations to generate potential future price paths.

Bitcoin Price Simulations

We have run Monte Carlo simulations for three different time horizons. Let's examine each one:

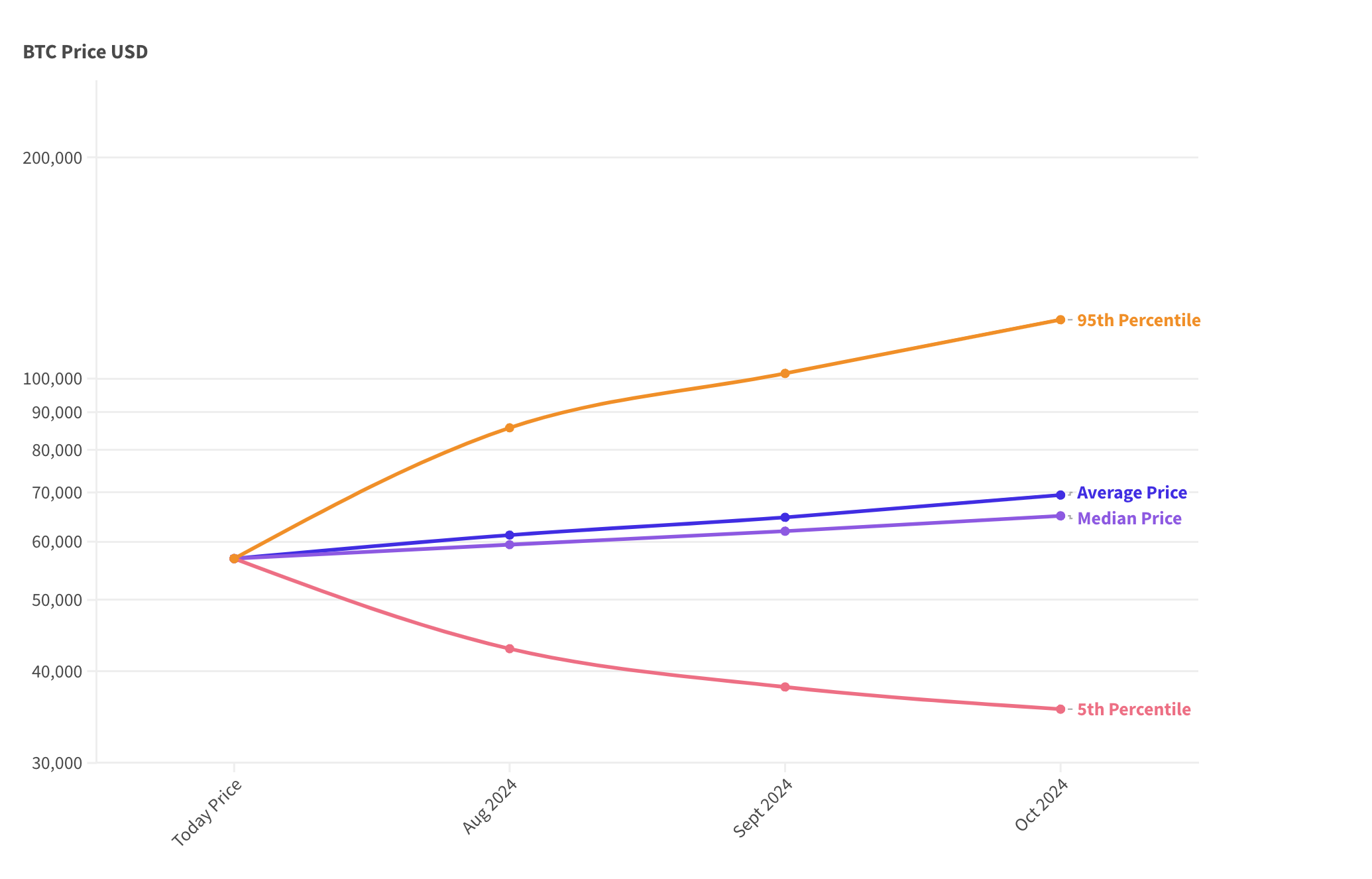

3-Month Simulation

In the short term, Bitcoin's price can be highly volatile. Our 3-month simulation shows:

- There is a wide range of potential outcomes, from $35k to $120k, with a median/average price of $65-69k.

- The maximum possibility is a slight upward trend (median/average price), with the possibility of extreme losses or gains in outlier events.

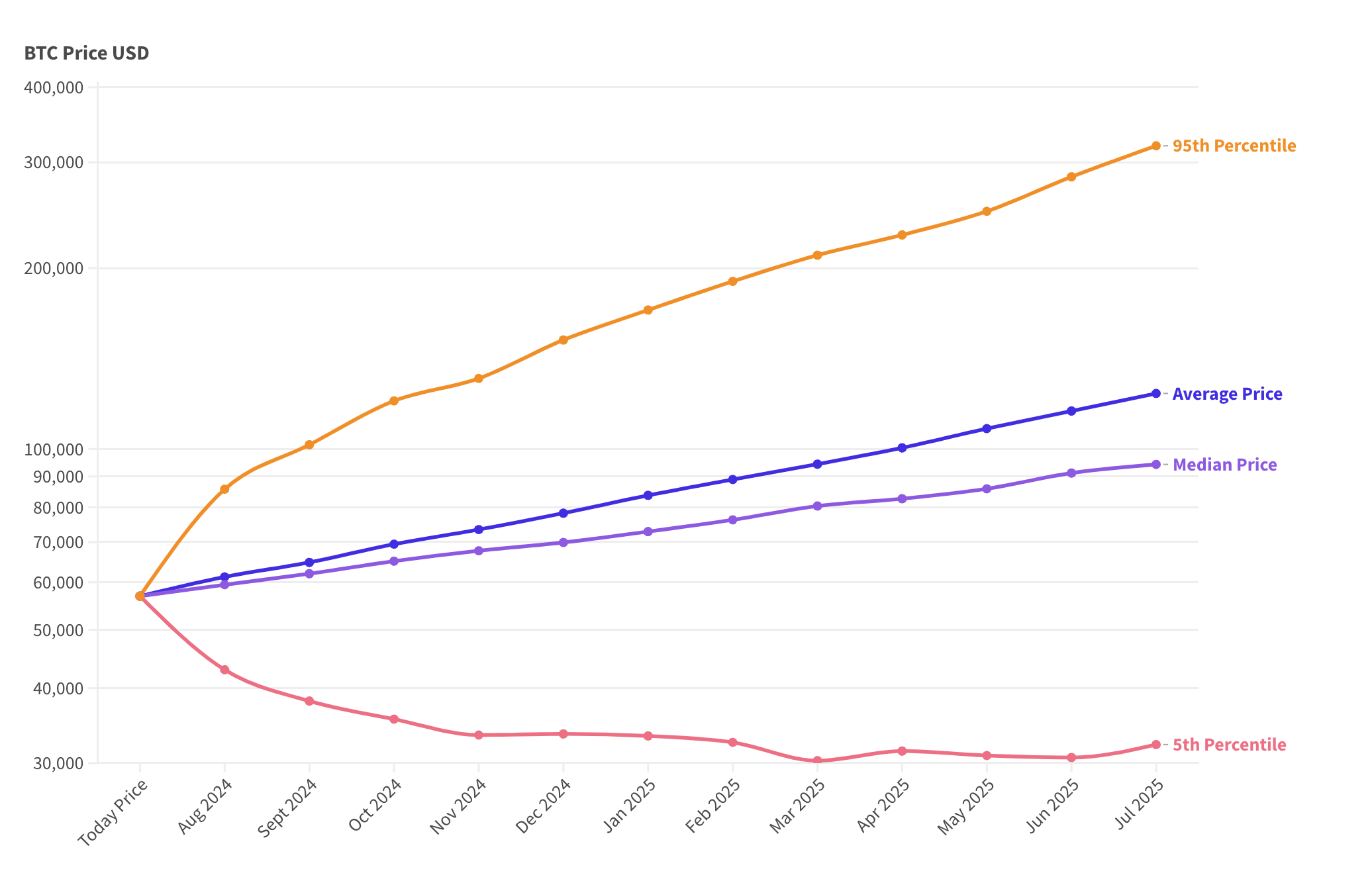

1-Year Simulation

Looking at a full year ahead:

- The price range naturally widens between $32k and $300k.

- We see a more pronounced upward trend in the average/median scenario between $94k-123k.

- The potential for both substantial gains and losses becomes more apparent.

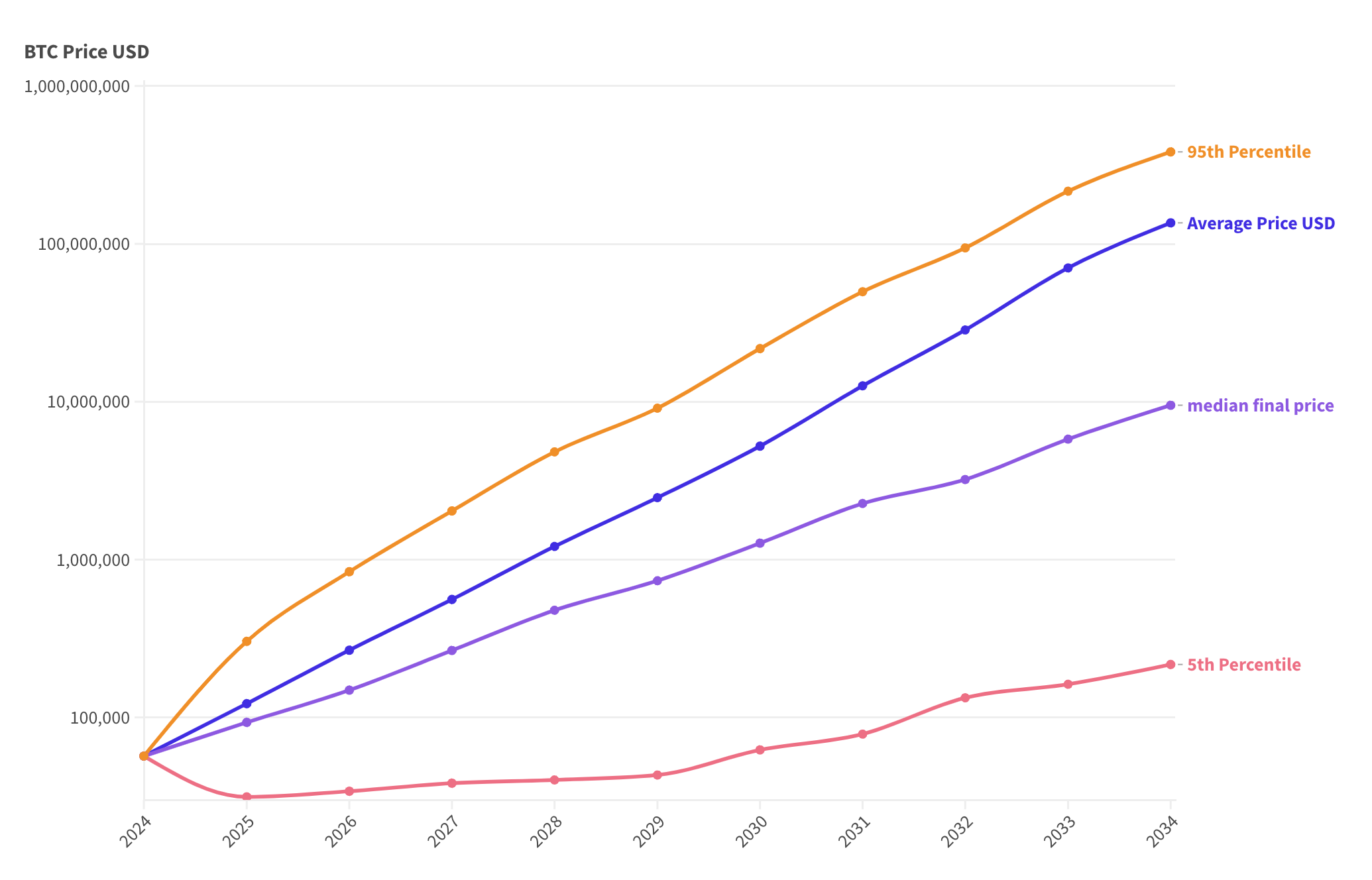

10-Year Simulation

Our long-term simulation reveals:

- There is an extensive range of potential outcomes between $200k (5th percentile) and $380 million (95th percentile) 😅.

- The 95th percentile at $380 million is absurd.

- The worst-case scenario (5th percentile), at $200k, is still ~4x from today.

- However, it also shows that Bitcoin could be below $100k by 2031 in the 5th percentile scenario.

- Bitcoin has historically been an asymmetric long-term bet, with a lower downside and a higher upside.

- The median price is $9.5 million, a reasonable good-case scenario.

Interpreting the Results

Understanding that these simulations are not predictions but illustrations of potential outcomes based on historical volatility and trends is crucial. They help us visualize:

- The range of possible prices.

- The likelihood of different scenarios.

- The potential for extreme outcomes.

Risk Management Implications

For Bitcoin investors, these simulations offer valuable insights for risk management:

- Time Horizon: Longer-term investors may be better positioned to weather short-term volatility.

- Risk Tolerance: Use these simulations to assess whether your Bitcoin investment aligns with your risk appetite and ensure your safety in worst-case (5th percentile) scenarios.

Limitations of the Model

While Monte Carlo simulations are powerful, they have limitations:

- They rely on historical data and assume past patterns will continue.

- They don't account for fundamental changes in the Bitcoin ecosystem or the broader economy.

- Extreme events (like regulatory changes) can occur outside the model's scope.

Conclusion

Monte Carlo simulations provide a valuable perspective on Bitcoin's potential price trajectories. By visualizing a range of possible outcomes, investors can:

- Set realistic expectations.

- Prepare for various scenarios.

- Make more informed decisions about position sizing and risk management.

Remember, no model can predict the future with certainty. Use these simulations as one tool in your broader investment strategy, always considering your personal financial goals and risk tolerance.

Was it useful? Please help me to improve!

With your feedback, I can improve these posts. Click on a link to vote:

Further Reading

For those interested in diving deeper into Monte Carlo simulations and cryptocurrency analysis, here are some recommended resources:

- "Monte Carlo Simulation and Finance" by Don L. McLeish

- "Mastering Bitcoin" by Andreas M. Antonopoulos

- "The Bitcoin Standard" by Saifedean Ammous

By providing this analysis, I aim to equip you with a powerful tool for understanding potential price ranges and managing risk. As the Bitcoin landscape evolves, staying informed and using sophisticated analysis techniques can help investors navigate this exciting and volatile market.

Remember, while these simulations offer valuable insights, they should be used with other forms of analysis and a thorough understanding of Bitcoin's fundamentals. Always research and consider consulting with a financial advisor before making investment decisions.

I hope you found this exploration of Bitcoin price simulations useful. If you have any questions or would like to discuss this further, please don't hesitate to contact me.

I want to credit Pawan Vyas, my team member, for his excellent work on this article.

See you in the next block.

Comments ()