Bitcoin Reaches $73K: Read This Before Your Next Move

Bitcoin crosses a new all-time high of $73k. The BTC Lighthouse temperature is now clearly in the Greed zone. Old investors are asking - should I sell? New investors are asking - should I buy? So, let's dive in to answer these questions.

Welcome to the BTC Lighthouse report.

Bitcoin crosses a new all-time high of $73k. The BTC Lighthouse temperature is now clearly in the Greed zone. Old investors are asking - should I sell? New investors are asking - should I buy? So, let's dive in to answer these questions.

📈 Bitcoin Performance

I have updated the Bitcoin performance graph and replaced the percentages with dollar amounts. This gives you a better understanding of Bitcoin's exponential returns than almost everything else.

🌡️ BTC Lighthouse Temperature

With Bitcoin's latest rally to $73k, the BTC Lighthouse temperature is now clearly in the Greed zone at 3.8.

❗On The Radar

🏦 FED Interest Rates

In my previous report, I mentioned that the last cycle was cut midway due to the FED's historical interest rate increase, which is on my radar.

According to last week's data, inflation rates are as expected, so the market expects no increase in interest rates.

🥊 Regulatory Setbacks

Regulatory triggers are also on the radar. When Bitcoin prices touch new all-time highs, it gets much attention. Regulators who don't like the asset also wake up, and the chances of regulatory backlash increase.

The current SEC chairman, Gary Gensler, does not like Bitcoin, and many Democrats, led by Elizabeth Warren, are anti-Bitcoin. However, with the approval of Bitcoin ETFs, the industry led by trillion-dollar asset managers like BlackRock and Fidelity, and the US elections on the horizon, I am not expecting any regulatory backlash.

With the record-breaking launch of Bitcoin ETFs, Bitcoin has finally established itself as an acceptable asset class.

⚠️ Risk

Things on the radar are known risks but are not threats for now. Despite the BTC Lighthouse temperature in the Greed zone, I am very bullish. The risk is what we don't know, what we don't expect. And it's with this humility that I give my advice at the end of this report.

💸 Bulls

Now for the stream of bullish news. There are so many that I will list a few of them briefly.

Bitcoin ETFs

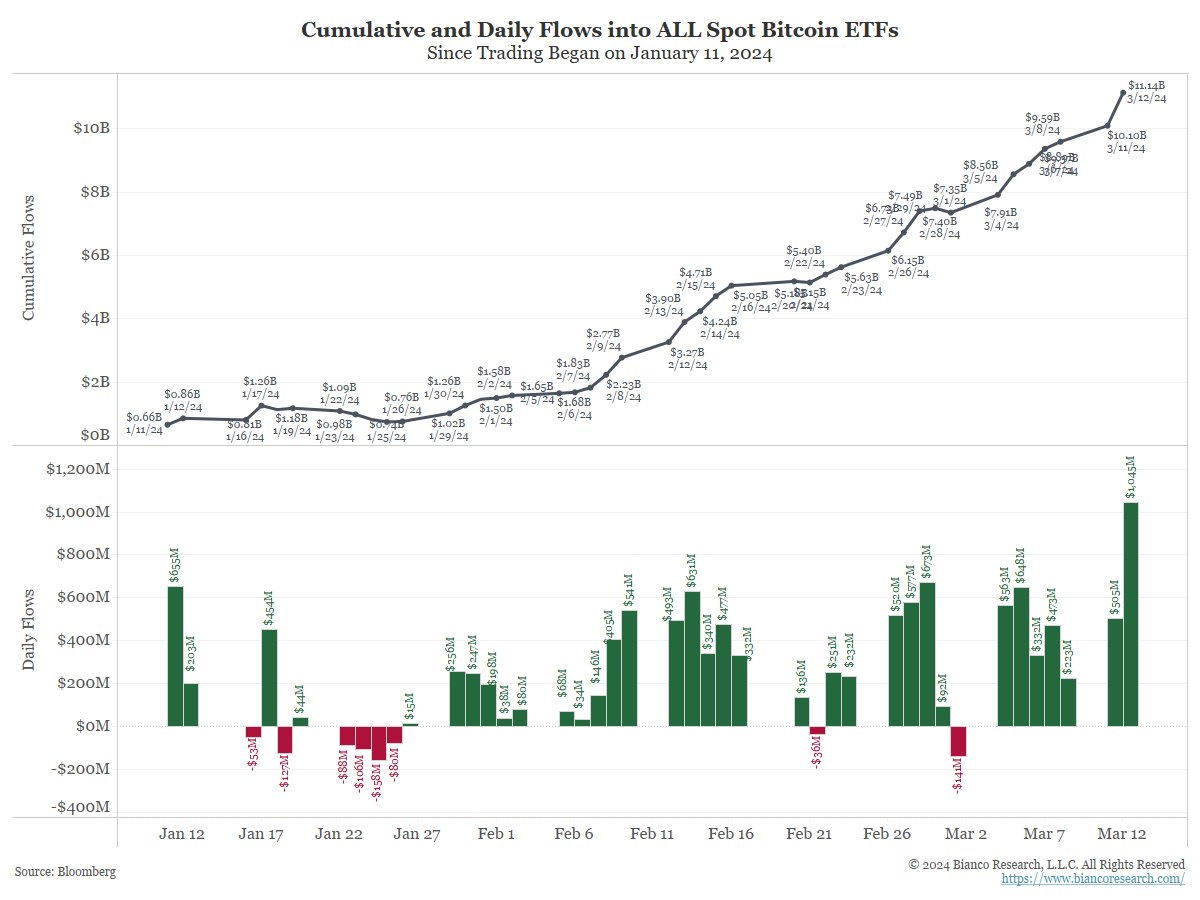

Bitcoin ETFs saw a jaw-dropping $11 B inflow since launch. On 12th March, they broke the daily record and saw an inflow of $1 B in a single day.

Funds Evaluating Bitcoin ETFs

A few examples:

NEW: Patient Capital Management files to invest up to 15% of its $1.4 billion Opportunity Trust into spot #Bitcoin ETFs pic.twitter.com/kZ5dk7Bs68

— Bitcoin Magazine (@BitcoinMagazine) March 12, 2024

Countries Evaluating Listing Bitcoin ETFs

More Institutions Are Coming

Only 30% of US wirehouses have allowed access to Bitcoin ETFs. The remaining 70% are coming, increasing the demand shock that Bitcoin is witnessing.

Bitcoin Crosses Silver, Meta, Berkshire Hathaway

The next target is Gold 🥇.

Media Coverage And FOMO

Every major news channel is marketing Bitcoin. This happens in each cycle once Bitcoin crosses the previous all-time high.

In the past two cycles, Bitcoin doubled in less than a month after crossing the previous all-time high.

- In December 2020, Bitcoin broke its previous all-time high of $19,600. By January 2021, the asset had already surged above $34,000.

- In 2013, after crossing a new all-time high of $1200 in April, the asset had surged to $2500 by June.

As Bitcoin crosses the previous all-time high, it starts a cycle of media coverage, FOMO, and speculators. We'll have to wait and watch if history repeats this time.

👺 This Time, It's Different

So we come to the dreaded statement by bulls like me. This time, it's different.

It IS different this time. The current cycle is the first cycle that institutions are driving. All previous cycles were driven by retail. Institutions are more long-term than retail.

You can see below that holders of less than 100 Bitcoin are the sellers, and 100+ Bitcoin wallets are buyers, that is, financial institutions.

I hate that Bitcoin is moving out of retail and into the hands of the rich; however, it is moving to long-term investors.

❓So What Should I Do?

This long post is to justify my advice, which remains the same as last week. It depends on your financial situation.

If you are an existing investor in a tight financial situation, sell periodically by dollar cost averaging over the next few weeks and months as the price increases. Make sure you have enough liquidity for your emergency fund. This is despite being extremely bullish. It is to cover the risk of the unknown.

I do not recommend booking profits for existing investors who are financially secure. But this is not a reflection of my view of the market. This follows the time-tested investing principles of investors like Warren Buffet.

- You want to hold an asset for the long term.

- You cannot make windfalls by trying to time the market because you cannot time the market.

For new investors, you are buying Bitcoin at a higher than fair value. Will Bitcoin dip back to fair value or the fear zone? Is anyone's guess? I do not recommend waiting if you are convinced of Bitcoin in the long term. Be prepared for dips and hold the asset for the long term.

Michael Saylor is buying Bitcoin aggressively at the current prices. He has bought 200,000 Bitcoin and is currently at a record-breaking profit. He was in the green for the first 1.5 years when he started buying Bitcoin. Then, when Bitcoin dipped, his portfolio value halved from May 2022 to October 2023. And now he's back in profit. This will be your journey with Bitcoin, too.

🃏Meme Corner

An X from Elon Musk; make sure you read the last line.

— Elon Musk (@elonmusk) March 13, 2024

Please give your comments and feedback on this report. See you in the next block.

Comments ()